Don’t Light Your Money on Fire

I know a lot of people who have gone broke because they told themselves, “I can afford the monthly payment.”

Use This Strategy to “De-Risk” Your Portfolio

When most people buy stocks, they find cheap ones and wonder why their trades don't work.

Your Top-Down Approach to Investing for Long-Term Success

The stock market is no place for amateurs.

This Number Dictates How Much You Can Save

The other night, my wife and I went out for dinner. When it came time to order dessert, I couldn’t help but think, “Is it really worth shelling out $13 for a piece of cake when we have other expenses, like building a big house?”

Forget the Snowball Method—Tackle Debt Another Way

Debt…

Where do you even start?

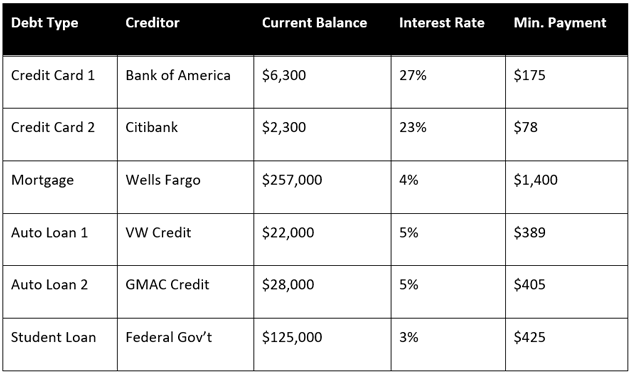

Step one is to pull your head out from under the covers and tally it up. All of it. No matter how scary that might be.

Here’s an example to get you started:

Total debt: $440,600.

Okay, you’ve faced reality. That is a BIG step in the right direction. Now you have to decide which debt to eliminate first.

There’s some bad advice out there about this. Some personal finance gurus recommend the “snowball method,” where you pay off the debt with the lowest balance first. It’s an easy win, and that’s supposed to motivate you to keep going.

I don’t like the snowball method at all. If you tackle the smallest debt first, it might not be the debt with the highest interest rate, and you’ll end up paying more in the long run.

A Better Way

A better way to tackle things is to look at your secured debts and your unsecured debts.

The mortgage and car loans are secured debts, meaning they’re backed by property. The bank will kick you out of your home if you don’t pay your mortgage. And the repo man will tow away your car if you don’t pay your car loan. Both are bad scenarios.

Things are even more brutal in places like Canada, where mortgages are recourse. If you don’t pay your mortgage there, the bank will kick you out and sell the house, just as it would in the US. However, if the proceeds don’t cover the balance on your mortgage, you’re still on the hook for the rest. That’s the part we don’t have here. Any leftover balance is the bank’s problem.

The credit card debt is unsecured debt. If you don’t pay the bill, eventually the account will go into collection, and you’ll get a lot of unpleasant phone calls.

You could try to consolidate, but it’s hard to make defaulted credit card debt go away. You might reach some sort of a settlement, but eventually, you will have to pay it unless you declare bankruptcy.

Then you’ve got student loans, which are their own special beast. Student loans cannot be discharged in bankruptcy. They just follow you around forever until you do something about it.

So, where do you start? Well, it’s hard to pay down debt if you don’t have a place to live or a car to drive to work.

Credit card debt carries higher interest rates than secured debt. So, in theory, you should pay your credit cards off first. But if you lose your house or your car—or both—you’re really stuck. So, it’s generally a good idea to prioritize your mortgage and your car loan first.

Once you’re on top of the priority secured debt, the student loans are next. Then you focus on unsecured debt with the highest interest rate.

|

Over the past 50 years, this portfolio has gone up 4,491% and is as set-it-and-forget-it as it comes. Jared Dillian's Awesome Portfolio is designed to outperform over decades, no matter what happens. If you're looking to take the stress and guesswork out of investing and sleep better at night knowing you have a proven plan for success in the markets, click here to see if the Awesome Portfolio is right for you. |

You Lose Money with the Snowball Method

Sure, the snowball method might give you some sort of psychological victory, but you lose money that way. You pay more interest. How is that good?

Say you have a $2,000 balance that carries an 8% interest rate and another $18,000 balance with a 21% interest rate. If you hack away at the smaller balance first, you are literally losing money every day. It might not be as satisfying to pay off the bigger balance first, but that is what you need to do. Take a big chunk out of that thing every time you get paid.

Keep in mind, you have to make the minimum payments on all of your debts during this whole process. The priorities we just covered are for debt elimination. It’s a system for ranking which debt to throw every last penny at until it’s gone.

Debt Is a Very Human Problem

A family member recently told me he had mid-five figures in credit card debt. This guy is paying $7,000 a year just in interest, which is terrible.

This is a very common problem. I’ve heard from so many people drowning in debt that I wrote a practical guidebook called Mastering Your Debt to help. It’s packed with straightforward strategies for eliminating your debt—all of it—for good.

There’s no way around it: If you are in debt, it is holding you back from fulfilling your potential. But you can get your life back.

Look, I get it—buying stuff is fun. You get cars, jewelry, vacations. But financial freedom is also fun. So is investing. You get to buy stocks and watch them go up. But you have to tackle your debt first or you’ll never get there. Click here to download Mastering Your Debt now.

Jared Dillian

|

Master Investing by Cutting Losses and Maximizing Gains

One of the fundamental principles in investing is knowing when to cut your losses.

‹ First < 11 12 13 14 15 > Last ›